- Deadline Varies Nv Business License Lookup

- Deadline Varies Nv Business License Verification

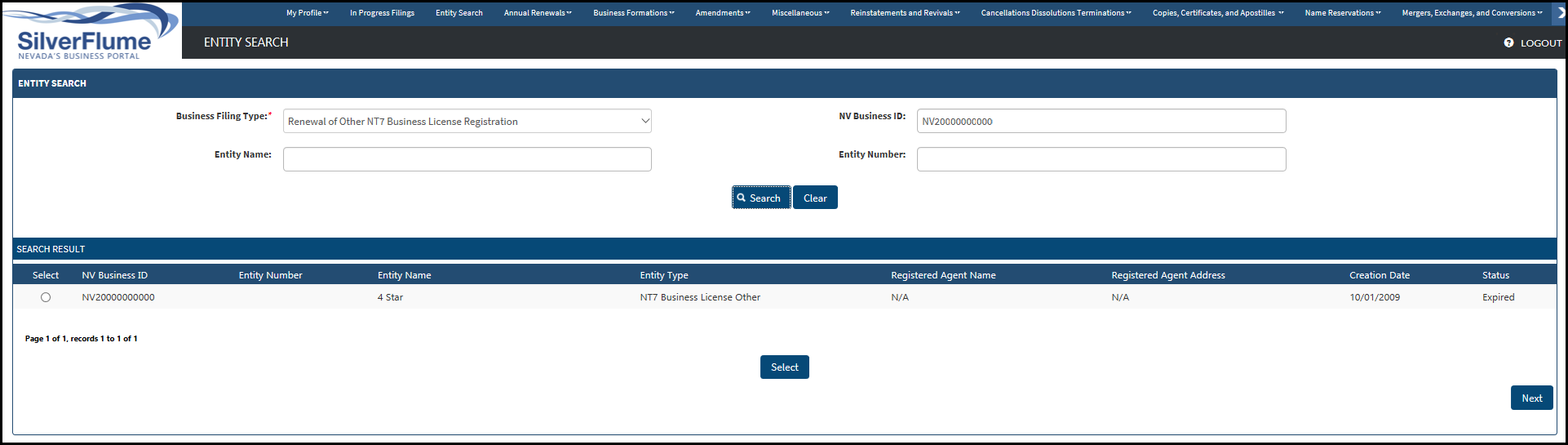

- Deadline Varies Nv Business License Renewal

Nevada State Business License. Businesses are required to obtain a license through the State of Nevada prior to obtaining a local business license. You will be required to list your NV License Number on your local license application. State licenses can be completed online. Business that are exempt from obtaining a state business license must. LAS VEGAS, NV (KXNT) - The deadline has been extended for local small business owners to apply for up to $15,000 in grants from Clark County. The deadline to apply for assistance had been Tuesday, but on Monday the county extended the deadline to the following Tuesday, August 11th. Are you authorized to manage this business? Click 'Ok' if you are authorized or 'Cancel' if you are not authorized. I declare under penalty of perjury that the information provided is true, correct and complete to the best of my knowledge and belief and acknowledge that pursuant to NRS 239.330, it is a category C felony to knowingly offer any false or forged instrument for filing in the Office. The procedures for getting your business license varies from one occupation to the next. You might have to meet specific educational or training requirements, or need experience in the field. You might have to take and pass a written exam before getting your license.

Registration requirements

About Business Licenses in Nevada The Nevada Secretary of State Business Center is responsible for business and corporate records. Corporations, limited liability companies, limited liability partnerships, and nonprofit corporations all file documents through the Secretary of State.

Register with the Department of Revenue and get a business license if you meet any of the following conditions:

Deadline Varies Nv Business License Lookup

- Your business requires city and state endorsements.

- You are doing business using a name other than your full name legal name.

- You plan to hire employees within the next 90 days.

- You sell a product or provide a service that requires the collection of sales tax.

- Your gross income is $12,000 per year or more.

- Your business is required to pay taxes or fees to the Department of Revenue.

- You are a buyer or processor of specialty wood products.

Deadline Varies Nv Business License Verification

Apply for a business license

If your business structure will be one of the following, you must file with the Washington Secretary of Statebefore filing the Business License Application:

- Washington (Domestic) Corporation

- Washington (Domestic) Partnership

- Washington (Domestic) Liability Company

- Washington (Domestic) Limited Liability Partnership

If you’re ready to start your business, you need to apply for your business license. Complete the Business Licensing Wizard to receive a list of agencies to contact, additional endorsements and helpful tips about your business license. When you receive your business license, you’ll be assigned a Unified Business Identifier (UBI) number. This number is unique to your business, and you’ll need it whenever you file your taxes or make changes to your business.

How to apply

- Start a scenario using the Business Licensing Wizard. You will have the option to Apply Now using our secure online system, or expand the By Mail to download and complete all the forms listed.

- Apply online applications are processed within 10 business days. Create an online account in our secure My DOR system. This account will also be used to file your taxes and make changes to your business.

- By mail complete the Business License Application, along with any additional forms, and payment to the address on the form. Mailed applications can take up to six weeks to process.

- The application fee for a Business License Application varies; see instructions on how to determine your processing fee. There are additional fees for each additional endorsement. See our city and state endorsements for fees and descriptions.

What happens next?

After your application is approved, you will receive packets of information from some or all of the following agencies:

Deadline Varies Nv Business License Renewal

Department of Revenue

- You will need to file an excise tax return monthly, quarterly, or annually, even if you have no business to report for a period. The department will assign you a filing frequency when you apply.

- You will receive a Unified Business Identifier (UBI) number that you will need to use when you file your taxes or make changes to your business.

- You will receive your business license, with any endorsements listed. Do not begin any business activity until you receive this license. Post the license at each business location.

Employment Security Department and the Department of Labor & Industries

- If you are hiring employees, submit quarterly reports for all active accounts, even if you have no employees and “0” active hours at any time.

Federal, state, and local requirements

You should also see if there are any other state or local agencies you need to contact. The Business Licensing Wizard gives you some of this information, but here are some additional resources:

- Check the city/town where your business will be located for any additional requirements.

- Check the complete list of licenses at Department of Licensing.

- Corporations must register with Secretary of the State, you will also need to apply for a Federal Employer Identification Number (EIN).

- Contractors – check out additional requirements and information about your licensing process.

- Using music in your business? There are copyright laws that may require you to purchase a license to use in your business, whether it is prerecorded, streamed, played by a live band, or used for karaoke. Read more about copyright laws and where to purchase a license.